Biden Would Repeat Dutch Mistakes in Regulating Freelancers

Stricter rules for contractors could lead to job losses.

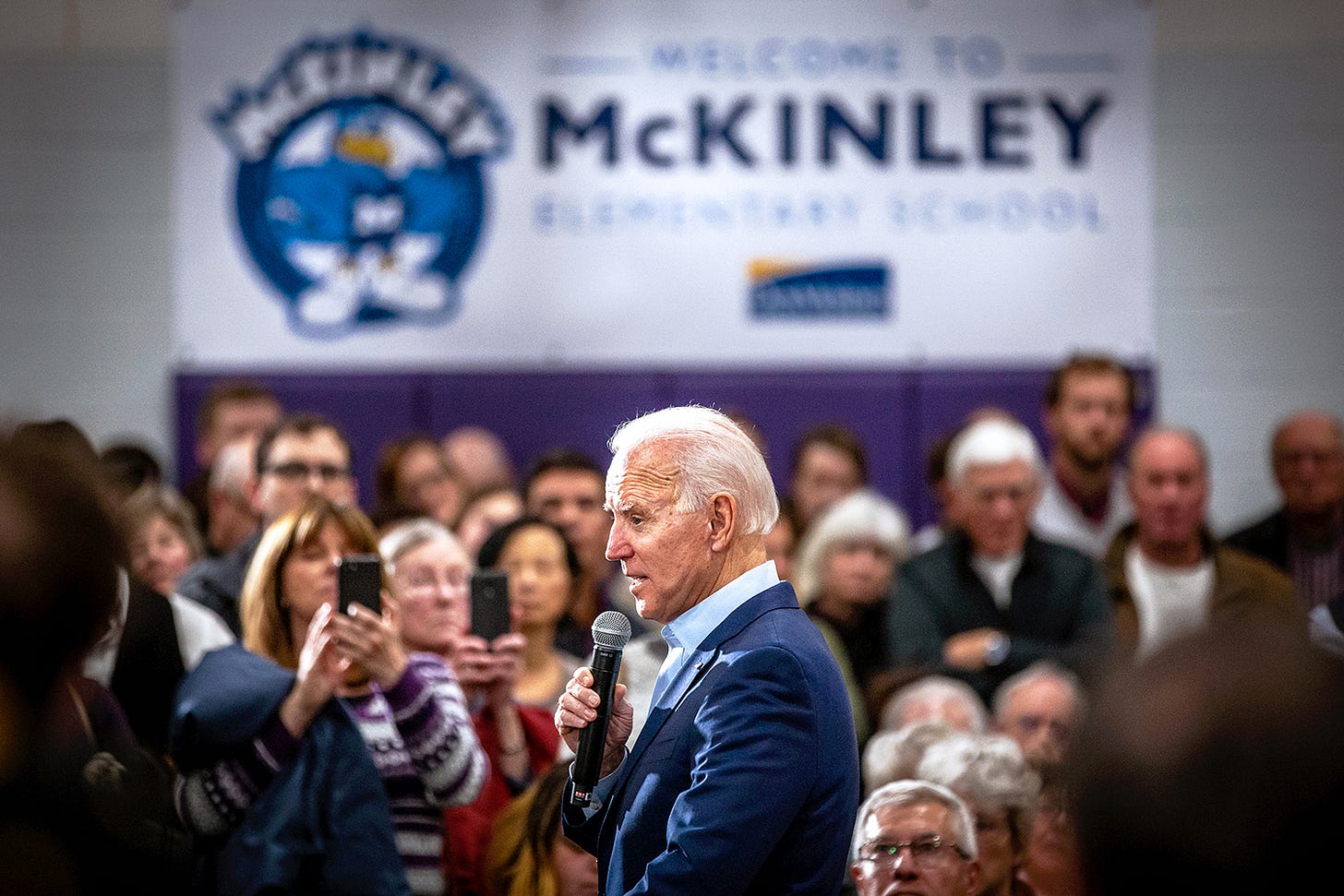

President Joe Biden would make the same mistake as the Netherlands in regulating independent work.

In 2015, the European country required employers to put freelancers on an open-ended contract after two years of work.

In an attempt to bring more workers into regular employment, a coalition government of the center-left Labor Party and center-right liberals also made it costlier and more time-consuming for companies to fire employees, and it increased severance pay.

The reforms didn’t cause a shift from freelancing to salaried employment. They did destroy some 77,000 — mostly part-time — jobs in child care, hospitality, nursing and other industries, according to an analysis by ABN Amro bank.

After Labor lost the election in 2017, the liberals formed a government with center parties and repealed the reforms. They made it cheaper for companies to hire, and easier to fire, employees. Freelancers were allowed three contracts per employer every three years.

Employment rose. There are more Dutch people in work than ever before. Almost every industry, from construction to schools to the national railway, struggles to fill vacancies.

Biden goes the other way

Biden’s Labor Department would repeat the Dutch Labor Party’s mistake by narrowing the definition of a contractor.

The Wall Street Journal warns:

Newspaper columnists, truck drivers, real estate agents, barbers, consultants and many other freelancers could be ensnared.

Who is an employee?

Proposed rules classify workers as employees when they are “economically dependent” on their employer.

Economic dependence would be determined by:

The worker’s opportunity for profit or loss depending on their ability to accept or decline jobs.

The control a worker has over price-setting, scheduling, supervision and other “economic aspects” of the work relationship.

That would mean an Uber driver, who is punished by the company’s algorithm when he declines a ride and can’t negotiate the price he’s paid, would be considered an employee.

The permanence of the work relationship. An open-ended contract suggests employee status.

“Entrepreneurial” investments, in a worker’s ability to do additional work, indicate contractor status. “Capital” investments, in tools to perform a specific job, indicate employee status.

This gets trickier, but now the hard part:

The extent to which the work is “integral” to the employer’s business.

The assumption is that “integral” work should be done by employees. But what if the work is integral but temporary, like a renovation or a systems upgrade? What if self-employment is the norm in an industry? In both America and the Netherlands, many surgeons contract for hospitals, where their work is clearly integral. Few want to become employees. If they are forced to, surgeons might find it harder to work in multiple hospitals. Patients would have to travel farther for surgeries.

Whether the workers’ skills are “specialized”, to perform certain tasks, or “managerial”, affecting success or failure.

Good luck to the bureaucrats who will have to figure that out.

Many prefer freelancing

The difference between contractor and employee status matters more in America than in Europe. In the Netherlands, freelancers don’t qualify for overtime and unemployment insurance either. But in the United States, they’re not even covered by minimum wage and they don’t have the right to unionize.

Yet millions of workers prefer it.

Keep reading with a 7-day free trial

Subscribe to Atlantic Sentinel to keep reading this post and get 7 days of free access to the full post archives.